"For the quarter, our business accelerated and achieved 21 per cent growth at CER demonstrating the strength of our portfolio. We also advanced our pipeline with the US filing acceptance for NASP in uncontrolled gout and the preparations for a new opportunity for olezarsen in severe hypertriglyceridemia, both expected to contribute significantly to long-term growth."

Guido Oelkers, President & CEO

Interim Report Q3 2025

Key figures Q3 2025

7,776

total revenue, SEK M

21%

revenue growth at CER

47%

adjusted EBITA, margin

Swedish Orphan Biovitrum AB (publ) (Sobi®) today announced its report for the third quarter 2025

Third Quarter 2025

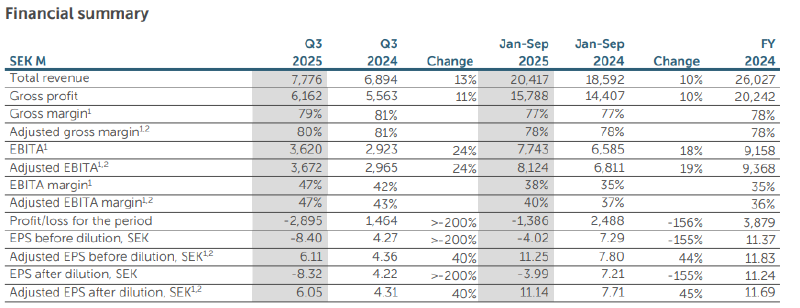

- Total revenue increased 13 per cent, 21 per cent at constant exchange rates, (CER)1, to SEK 7,776 M (6,894)

- Haematology revenue increased 26 per cent at CER to SEK 4,771 M (4,000), mainly driven by Altuvoct of SEK 769 M (129), strong sales of Dopteletof SEK 1,408 M (1,039) and sales of Aspaveli/Empaveli of SEK 317 M (270), somewhat offset by low Vonjo sales of SEK 307 M (379)

- Immunology revenue increased 12 per cent at CER to SEK 2,658 M (2,583), driven by strong sales of Gamifant of SEK 733 M (405) and Kineret sales of SEK 769 M (699), somewhat offset by lower Beyfortus royalty of SEK 1,166 M (1,478)

- Revenue from the strategic portfolio1* grew by 39 per cent at CER to SEK 5,001 M (3,830)

- The product and marketing right Vonjo was impaired by SEK 6,612 M before tax. The impairment has not affected cash flow and is reported as items affecting comparability (IAC2)

- The adjusted EBITAmargin1,2 was 47 per cent (43), excluding IAC2 of SEK -6,664 M. EBITA1 was SEK 3,620 M (2,923), corresponding to a margin of 47 per cent (42). EBIT was SEK -3,858 M (2,038) including the impairment of Vonjo by SEK 6,612 M

- Earnings per share (EPS) before dilution was SEK -8.40 (4.27) and EPS after dilution was SEK -8.32 (4.22). Adjusted EPS before dilution1 was SEK 6.11 (4.36) and adjusted EPS after dilution1 was SEK 6.05 (4.31). Cash flow from operating activities was SEK 1,840 M (1,201)

Outlook 2025 - updated

- Revenue is anticipated to grow at low double-digit percentage at CER

(previously high-single-digit)

- Adjusted EBITA margin adjusted is anticipated to be at mid-to-high 30s percentage of revenue

(previously mid-30s)

|

1. Alternative Performance Measures (APMs). |

|

2. Items affecting comparability (IAC). |

* The strategic portfolio includes Sobi's medicines Altuvoct, Aspaveli/Empaveli, Doptelet, Gamifant, Vonjo and Zynlonta, and royalty on Sanofi's sales of Altuviiio and Beyfortus.

Investors, analysts, and the media are invited to a conference call on the same day at 13:00 CEST, 12:00 BST, and 07:00 EDT. The call will include a presentation of the results and a Q&A session.

The presentation can be followed live here or afterwards on sobi.com. The slides will be made available on sobi.com before the conference call.

To participate in the conference call, please use the following dial-in details:

Sweden: +46 8 5051 0031

United Kingdom: +44 207 107 06 13

United States: +1 631 570 56 13

For other countries, please find the details here.

We are a global biopharma company unlocking the potential of breakthrough innovations, transforming everyday life for people living with rare diseases.

Our therapies are concentrated within the areas of Haematology, Immunology and Specialty Care.

We contribute to societies by improving access to treatment of rare diseases.

Find out more about our business and financial performance.

Here we present our most recent press releases, stories, news articles, and images.

Every day, we work actively to find better ways to understand and meet patient needs.

- About

- Therapeutic areas

- Medicines

- Sustainability

- Investors

- News & Stories

- Careers